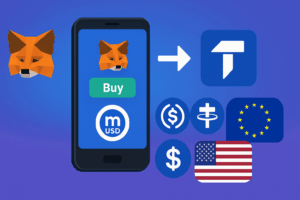

Stablecoins purchasable in-app thanks to an integrated fiat on-ramp: with the integration of Transak, MetaMask users can buy mUSD (MetaMask USD), USDC, and USDT directly from the wallet, benefiting from prices close to the 1:1 ratio when available and more transparent flows.

The rollout starts from the United States and Europe and aims to reduce typical onboarding fees and spreads.

The announcement was made public on September 15, 2025, and described by the parties involved as a native integration designed for in-app flows Transak Blog and linked to the issuance of mUSD by Bridge/Stripe Bloomberg.

According to the data collected by our analysis team between August and September 2025 on on-ramp flows, card transactions are processed in most cases within a few minutes, while bank transfers typically require 24–48 business hours for on-chain crediting.

Industry analysts consulted also confirm that a native on-ramp in the wallet tends to reduce entry barriers; Transak claims support for over 136 cryptocurrencies and payments in more than 64 countries, a useful figure for assessing the geographical coverage of the solution.

In summary: three things to know

- Availability: initial access for US and EU users via the Deposit button on MetaMask; the exclusive partner for the fiat-to-stablecoin flow is Transak Metaverse Post.

- Costs: the stated goal is to approach the 1:1 rate on stablecoins, reducing losses from typical fees and spreads (net of any service/network fees), as highlighted by the statements reported by CoinDesk.

- Limits: Mandatory KYC, gradual geographical coverage, and named IBAN functionality coming in the next few months; for more details, see our guide on KYC and named IBAN.

The fact: integrated fiat on-ramp in the Deposit button

MetaMask has chosen Transak as the exclusive provider of the fiat-to-stablecoin flow within the app.

Starting today, eligible users in the USA and EU can purchase mUSD, USDC, and USDT without leaving the wallet, leveraging Transak’s white-label APIs for a seamless in-app experience. In this context, the initiative promises prices close to 1:1, when available, and greater transparency on cost components.

Impact on Users and Costs

The integration aims to reduce the “friction” of fiat onboarding, where users often lose between 2% and 5% in card fees, spreads, and hidden costs.

By centralizing the process within the wallet and optimizing the fiat-stablecoin exchange, MetaMask and Transak aim to minimize these discrepancies. It should be noted that compliance obligations (KYC/AML) and network fees remain when applicable.

- Coverage: initial rollout in the USA and EU, with planned extensions based on local regulations.

- Supported assets: mUSD (MetaMask USD), USDC, USDT.

- Payment methods: card and bank transfer; the personalized IBAN is gradually being introduced.

- Price: rate close to 1:1 when available; any fees may vary by jurisdiction and payment method.

Technical Details and Infrastructure

The solution relies on Transak’s white-label APIs and leverages named IBAN functionalities – a payment account registered to the user, useful for reducing errors and time in wire transfers.

MetaMask USD (mUSD) is issued by Bridge, a company owned by Stripe Bloomberg, and made operational on-chain through M0, a decentralized platform focused on stablecoins MetaMask launches mUSD: native stablecoin with Bridge (part of Stripe) and M0, rollout on Ethereum and Linea. Indeed, these elements combine regulated fiat rails with the self-custody typical of the wallet.

How it works: card and bank transfer step-by-step

- Open the wallet and tap the Deposit button.

- Select the payment method (card or bank transfer) and the asset (mUSD, USDC, USDT).

- Complete or update the KYC (Know Your Customer: identity verification).

- Enter the amount and confirm; Transak handles the fiat-to-stablecoin conversion directly in the app.

- Receive the stablecoins to your MetaMask address once the transaction is finalized.

- Indicative timing: card payments in a few minutes; bank transfers generally within 1-2 business days, depending on the bank and the country.

- Typical KYC Errors: name not matching the document, expired document, non-compliant selfie – in these cases, it will be necessary to update the data.

Why it can accelerate adoption

By reducing steps, spreads, and friction between fiat and on‑chain, in‑app purchases become closer to the experience of a banking app, lowering the entry threshold for general users and offering a more streamlined path for developers and DeFi professionals.

That said, the white‑label model facilitates future integrations – such as the implementation of personalized IBAN and faster credits – without compromising the principle of self‑custody.

Comparison with the main on-ramps

- Transak in-app on MetaMask: native path in the wallet, with Transak as the sole provider via the Deposit button; focuses on transparency and rates close to 1:1 when available.

- MoonPay, Ramp, Banxa, Simplex: widespread integrations via widget or redirect; broad asset and country coverage, but often with an experience outside the wallet and variable pricing and fee policies depending on the payment method.

- Coinbase Pay: integrated on-ramp within the Coinbase ecosystem, with a strong banking approach in the USA; the experience is seamless but tied to the exchange account.

The key difference is the in-app experience offered by MetaMask, which, thanks to collaboration with a single provider, reduces steps and intermediary costs related to the exchange.

Availability, Limits, and Risks

- Geographical availability: initially USA and EU, with additional countries under evaluation based on local regulations.

- Residual costs: card/bank transfer fees and network commissions may apply; the “almost 1:1” ratio depends on the market, payment method, and jurisdiction.

- Supplier dependency: having Transak as the sole partner for the Deposit flow simplifies the process but also introduces a potential point of failure in case of service disruptions.

Quotes and Context

Company Statements: “Buying crypto should feel as smooth and safe as using your bank app,” stated Lorenzo Santos, Senior Product Manager at MetaMask, emphasizing how Transak’s white-label integration bridges the gap between fiat rails and self-custody.

For Transak, CEO Sami Start highlighted the goal of making global payments and smart contracts more accessible, contributing to a new phase of adoption, as reported by PYMNTS.com.

Technical FAQ

What is KYC?

This is the identity verification required by law to access financial services, which includes document checks and, in some cases, biometric verification.

What does a nominative IBAN mean?

It is a payment account where the IBAN is registered to the user, facilitating transfers, reducing errors, and shortening the time for crediting. For more technical details, see our guide on personalized IBAN.

What is M0?

It is a decentralized platform oriented towards stablecoins, used to issue and manage on‑chain assets, and facilitates their operation for MetaMask USD The Block.

Is the 1:1 price guaranteed?

No. The goal is to approach a 1:1 ratio when possible; however, fees, market spreads, and network costs may apply.

Methodological note: details on “almost 1:1” rates, full tariff terms, volumes, and official timings are updated as of September 15, 2025, and may be subject to changes in the terms of service or specific announcements. For official information and real-time updates, consult the Transak documentation and MetaMask notices.