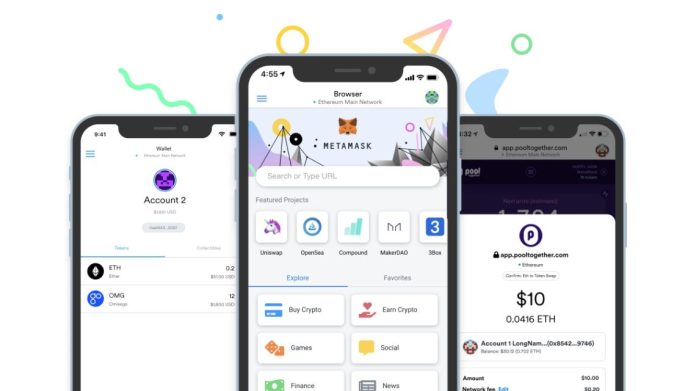

In this article we cover the Metamask airdrop and everything you need to do to become eligible with your crypto address.

Consensys, the company behind the development of the non-custodial wallet, has raised $715 million in investment and may soon release a utility token for its web3 product.

Full details below.

Metamask airdrop: the Consensys company

Before discussing Metamask’s upcoming airdrop, it is appropriate to dedicate a short introduction to Consensys, a New York-based technology company engaged in non-custodial wallet software development.

The company supports various infrastructures in the web3 field with different products dedicated to users and developers.

In addition to Metamask, the Consensys team also manages the zk-evm Linea blockchain and the Infura smart concrat development platform.

Founded in October 2014 by entrepreneur Joseph Lubin, the company immediately focused on creating services and applications orbiting the Ethereum blockchain, to the point where it has now become a benchmark for the entire blockchain landscape.

Given its success over the years, Consensys decided to open its own label ventures to explore the world of private investment of early stage projects.

The company’s latest investments include Coinhouse, Fractal, Telos, Aut Labs ,Blockapps, Gnosis and Juno.

In addition to funding crypto startups itself, the company has raised several investments from Animoca Brands, Coinbase Ventures HBSC and ParaFi Capital totaling $715 million.

Selling the growth of the Metamask ecosystem and the volume of users who use the decentralized wallet on a daily basis, it seems feasible to think that Consensys may use some of these funds to launch its own token utility.

Several rumors speak of an imminent launch, with rewards for all early adopters of the software. Coinmarketcap has already listed the page dedicated to the future $MASK token, hinting that Metamask may announce a listing in a few months.

Given the reputation and high capital in Consensys’ hands, it would be a great shame to miss Metamask’s airdrop.

All the steps to take to be eligible for Metamask’s airdrop

All you need to do to become eligible for Metamask airdrop is to perform some simple steps through the browser extension, without connecting to any external platform.

First of all, if you have not already downloaded Metamask, you can do so here: after downloading and creating an account by creating a new seed phrase or retrieving an existing one, you will need to deposit funds on the Ethereum chain.

There are basically two ways to do this: deposit from centralized exchanges such as Binance, Coinbase, Kraken and Biget or purchase crypto directly by credit card or Sepa transfer.

Once you have funded your wallet you will have to use the “swap” function internal to “Metamask Portfolio” to create trading volumes. Indicatively, it is advisable to carry out at least 10 swaps between now and the next 3 months for a minimum total value of $1500 ($150 per swap).

These numbers represent a likely estimate based on the average number of transactions executed by all Metamask airdrop participants: you can try to conduct fewer transactions and with smaller capital but you may be excluded from the list of eligible addresses.

According to data from Dune Analytics of the 2.8 million addresses that used the feature the wallet’s internal router, about 1.5 million executed between 1 and 5 transactions, hence better to be a step ahead of the crowd.

Trading fees will be slightly higher than what you will find on the major DEXs (Uniswap, Sushiswap) but it will be worth paying a few dollars more given the high stakes.

If you want to save money, perform trades on other cheaper networks such as Optimism, Arbitrum, BNB chain but do at least one swap on Ethereum.

After generating some swap volume, the last key thing to do is to perform interoperability trades between different chains using the “bridge” function.

As with swaps, it is advisable to perform at least 10 moves and bring your assets across all 6 supported networks, for a minimum total volume of $1,500. In general, the more on-chain transfers that are made, the higher the probability of receiving Metamask’s airdrop and earning a high allocation of the $MASK token.

The fees to be paid to the provider correspond to 0.875% of the total amount sent, to which network fees should be added. As mentioned earlier, the operational costs for this airdrop are high, but the rewards can reach over $2,000 per eligible address

Tips and other useful info

There are then other steps that you should take to increase your chances of receiving Metamask airdrop.

First, given the growing interest in liquid staking protocols, it would be advisable to interact with the “stake” section of Metamask Portfolio by acting as staking providers of ETH and/or MATIC.

By relying on protocols such as Lido, RocketPool or Stader, you can take advantage of some of the best liquid staking services without having to leave Metamask.

It is recommended to deposit a minimum counter value of $50, possibly on either Ethereum or Polygon, and hold the LSD (liquid staking derivatives) token for at least 1 month.

Furthermore, it is worth knowing that if you want to be successful in the Metamask airdrop, you will have to be diligent and try to get in touch several times with the various internal functions of the wallet and also interact with external protocols such as Uniswap, 1Inch, Sushiswap, etc.

In order not to result as a sybil farmer, better hold a minimum amount of 0.05 ETH on the Ethereum Mainnet, and perform at least 1-2 token transfers to an external address (of course still controlled by you).

Avoid performing the same transactions on multiple addresses, especially if grouped within a single account and funded by a single entity: it is much better to have several accounts, with deposits made from distinct CEXs, and to practice different transactions at different times.

Doing so will multiply the chances of receiving Metamask airdrop and earn a higher $MASK token allocation.

To keep track of your progress and check in real time how many transactions have been made and how much volume has been traded, you can rely on this tracker from Dune Analytics. By pasting your address on the “wallet address” entry and clicking “run” you will get a lot of useful information.